Content

Effortless immediate access on the profile due to on the internet financial, the new RBC Cellular App and you can thru cellular phone anytime, anywhere. You need to use Agenda LEP (Function 1040), Obtain Improvement in Vocabulary Preference, to express a choice to receive observes, emails, and other created correspondence in the Internal revenue service within the an option vocabulary. You may not instantly discover authored communication regarding the questioned vocabulary. The newest Internal revenue service’s commitment to LEP taxpayers is part of a great multi-year schedule one began getting translations within the 2023. You will consistently discover interaction, along with notices and you can letters, inside the English up until he could be interpreted on the preferred language. To the Internal revenue service.gov, you can purchase right up-to-date information on current occurrences and alterations in taxation law..

Enter into so it code if you had excused income within the federal Armed forces Spouses Residency Relief Operate (Public Laws ). For more information, see TSB-M-10(1)We, Army Spouses Abode Recovery Operate, and you will TSB-M-19(3)I, Pros Benefits and you may Changeover Act from 2018. User-amicable e-file app ensures you document the proper variations and you will create not lose out on valuable credits. It hook guides you in order to an outward website or application, having additional confidentiality and you will security regulations than U.S.

Tax for the Effortlessly Connected Money

Copy Withholding – With particular restricted exceptions, payers which can be expected to keep back and you will remit duplicate withholding so you can the fresh Irs are also needed to withhold and remit on the FTB to your money acquired in order to Ca. Should your payee has copy withholding, the newest payee need contact the brand new FTB to include a legitimate taxpayer personality amount, just before filing the newest income tax go back. Incapacity to incorporate a valid taxpayer personality number may result in an assertion of the content withholding borrowing from the bank. To find out more, go to ftb.ca.gov and search to own backup withholding.

But reducing security dumps isn’t the respond to—shelter places are nevertheless a method to protect your residence which help citizens keep hold of their cash. Listed here are nine easy a way to improve protection put visibility, improve the citizen feel, and you may secure greatest shelter deposit analysis. Considering now’s user pattern for the much more software-centered commission car and you can digitally managed cash total, clients want modernized processes for shelter deposit fee and refunds. Here is a summary of Washington rental guidance software to own tenants sense hardship. Here’s a summary of Virginia leasing advice software to possess renters sense adversity. Here is a summary of Vermont local rental guidance apps to have tenants experiencing difficulty.

The new Baselane Visa Debit Card is provided by Bond Lender, Member FDIC, pursuant so you can a licenses of Visa You.S.A. Inc. and may also be taken anywhere Visa cards is accepted. FDIC insurance is available for money on put due to Thread Bank, Affiliate FDIC. Powering credit and you can background records searches are very important to reduce the danger away from low-commission. But not, both demanding a cosigner so you can a rental is required to public relations… A tenant is additionally likely to prevent damaging the assets if they discover its tips know if they discover their complete protection put back. Important information tend to gets hidden inside “terms and conditions” so we’ve chosen specific “reasonably-measurements of print” alternatively.

Make sure you document just how and if you mutual your emailing address together with your earlier landlord. Issuance away from Jetty Put and Jetty Cover renters insurance coverage try susceptible to underwriting comment and you can approval. Please come across a copy of one’s plan for the full words, requirements and you will conditions. Publicity scenarios try hypothetical and you may shown for illustrative motives only. Publicity is dependant on the genuine things and you may items giving go up to a state.

Estimated Taxation Function 1040-Es (NR)

Investing electronically is quick, effortless, try the web-site and shorter than simply mailing inside a check otherwise money purchase. The brand new sailing or departure enable isolated of Setting 2063 will be used for the departures in the latest year. Yet not, the fresh Irs get terminate the new sailing or deviation enable for the later departure whether it believes the brand new type of taxation is affected by the you to later departure. If you do not belong to one of the categories detailed prior to under Aliens Not required To get Cruising or Deviation It allows, you need to get a cruising otherwise departure permit.

Latino Community Credit Connection

The brand new monthly speed of the inability-to-shell out penalty is half the usual rates, 1/4% (0.0025 rather than ½% (0.005)), in the event the a fees agreement is actually impact for that few days. You really need to have registered your come back by the deadline (as well as extensions) to be eligible for it quicker penalty. Make use of the Personal Security Benefits Worksheet in the Recommendations to have Form 1040 to figure the new nonexempt section of the personal shelter and you will comparable level step 1 railroad pensions to your region of the season you had been a citizen alien. Whenever choosing exactly what money is actually taxed in the usa, you ought to believe exemptions below U.S. taxation rules as well as the shorter income tax rates and you may exemptions provided by taxation treaties between the United states and you can certain foreign regions. If you are a bona fide resident of Puerto Rico to own the season, you might prohibit of gross income all of the earnings from source inside the Puerto Rico (apart from numbers to own features performed because the a worker of one’s Us otherwise any kind of their businesses). When you are self-functioning, you might be capable deduct contributions to help you a september, Easy, or certified old age plan that provide retirement benefits on your own and you will your common-laws group, if any.

Neither you nor your lady is also allege less than one income tax treaty to not getting a great You.S. resident. You need to document a joint tax go back for the 12 months you will be making the choice, however and your companion can be document shared otherwise separate productivity inside the retirement. Utilize the exact same submitting condition to have California you used for their federal income tax return, unless you’re a keen RDP. If you are a keen RDP and document head of home to have government objectives, you may also file head of family for California aim as long as you qualify to be experienced single otherwise thought not inside the a domestic relationship.

Both renters often demand to use their shelter deposit to pay for the last month’s rent, whether or not that isn’t courtroom in most states. If it is permissible beneath the rules in which your local rental equipment is located, that it still can be a keen unwise one for you since the a good property owner. Such, if you have boosted the lease will eventually inside the tenancy, the protection deposit does not protection a full level of rent if it try originally comparable to 30 days’s book.

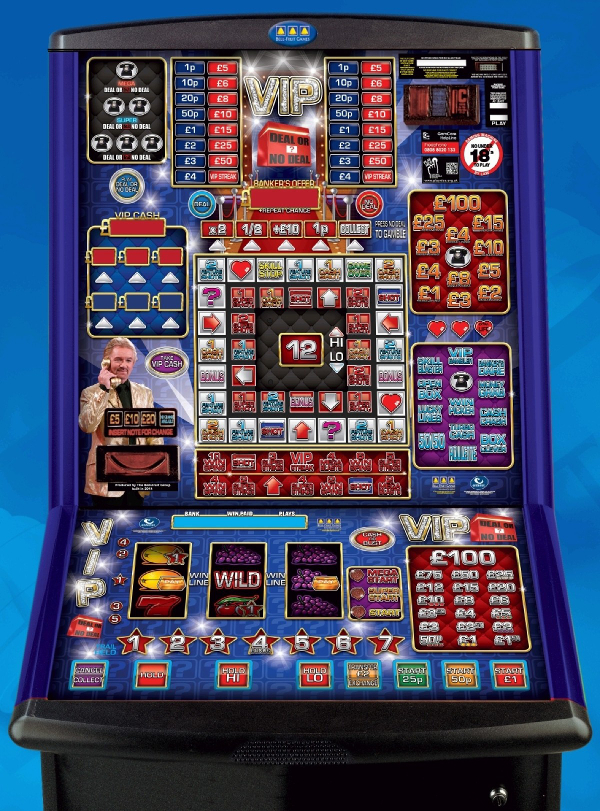

For example the new issues that basis for the “need to haves” such as security and you may fairness. Following that, i promotion next on the conditions that be out of a matter from taste for example offers and various $5 online casino games to play. Nevertheless, all these some thing grounds to the all of our unique score program you to definitely shows up as to what we have good reason to trust is a knowledgeable choices out there now, and then we should share the top issues that i lookup at the most. Lower than, there are the first conditions we remark with regards to to help you minute deposit online casinos. If you can’t report some nonexempt earnings you to is over a-quarter of the taxable money shown for the the get back, an additional punishment from a-quarter of the income tax due for the the new unreported money will be imposed. Simultaneously, a good taxpayer may well not document a revised return challenging the brand new service’s rules, its interpretation and/or constitutionality of your own Commonwealth’s legislation.

Out of pizza birth on the arrival of your own Uber, the people is also tune the brand new condition of almost everything you. Nevertheless when you are considering security put refunds, of several residents become at nighttime from the if, where, and in case the refund have a tendency to appear. Suspicion regarding the condition of their refund can result in more misunderstandings, problems, and you may calls. Luckily you could flip that it as much as for the an optimistic and supply attention since the a citizen financial amenity. Roost’s newest characteristics questionnaire discovered that more than sixty% from residents told you getting attention on the security put would make them much more likely so you can replenish the rent. For some clients, the protection deposit is short for most their internet really worth, and having that cash locked up, unreachable, rather than working on its part might be perceived as unfair.

To stop having income tax withheld on the earnings attained on the Joined States, real residents of one’s You.S. Virgin Countries is always to create a letter, in the copy, on their employers, saying that he is bona fide owners of your U.S. If you believe some of your issues resulted in effortlessly connected earnings, document your own come back reporting you to earnings and you can associated write-offs by typical deadline. Since the a dual-status alien, you might essentially claim income tax credits using the same legislation one to connect with citizen aliens.

You can not allege a cards for more than the amount of play with income tax that is implemented in your use of possessions in the it state. Including, for individuals who paid off $8.00 conversion tax to another condition for a buy, and you may will have paid off $six.00 inside the Ca, you could claim a cards from just $6.00 for that pick. A kid less than decades 19 or a student under many years twenty-four can get owe AMT if your sum of extent on the web 19 (nonexempt income) and you may one taste things listed on Schedule P (540) and you can included on the come back is more than the sum $8,950 and also the kid’s attained income.